Architectural Practice

Many homeowners who desire extra space without moving often opt for a home extension. Luckily, there are numerous financing options available for a house extension to suit different budgets and requirements.

First, it’s important to establish what type of extension suits you, your home, lifestyle and budget.

Homeowners can choose from a range of home extensions to expand their living space and accommodate their changing needs.

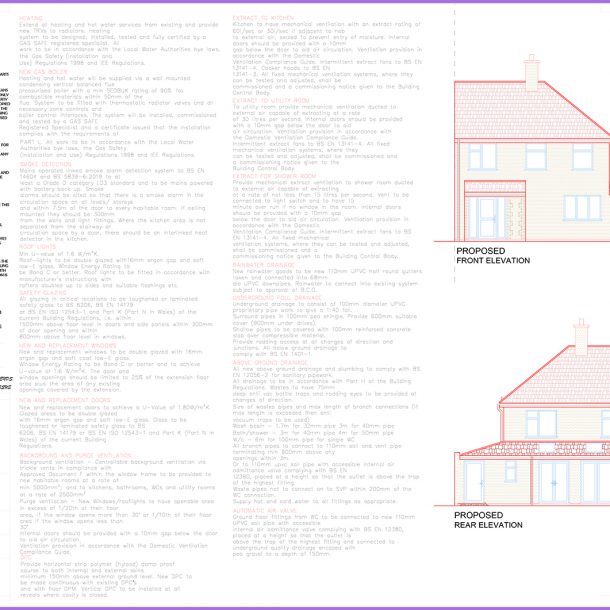

Single-storey extensions are popular for adding an extra room or space to the ground floor, while double-storey extensions provide additional living space on two levels.

Conservatories and orangeries are ideal for those who want to enjoy natural light and outdoor views, and they can be used as sunrooms, greenhouses, or additional living areas.

Loft conversions and basement conversions offer a cost-effective way to add extra living space by converting unused or underutilised areas into comfortable living spaces such as bedrooms, offices, or playrooms.

The cost of a house extension can vary depending on various factors such as the size, design, materials, location, and labour costs. The cost can also vary widely depending on the location and the type of extension.

It’s essential to get a detailed estimate from a qualified contractor to determine the cost of your house extension accurately. We can assess your requirements, budget, and design preferences and provide you with a detailed quote that includes all the necessary costs involved.

There are several ways to finance a house extension, depending on your financial situation and preferences:

If you have enough savings, using them to finance your house extension may be a wise option, as you won’t have to pay interest on a loan or credit.

This type of loan allows you to borrow money against the equity you have built up in your home. The interest rates are usually lower than credit cards or personal loans, and the repayment period is longer.

You can remortgage your home to borrow additional funds for your extension. This option allows you to spread the cost over a longer period, but it may result in higher overall interest payments.

If you need a smaller amount of money, you can consider using a credit card or taking out a personal loan. However, the interest rates are typically higher than home equity loans or remortgaging.

It’s essential to consider your financial situation and compare the different financing options available to choose the one that suits your needs and budget the best.

Our architectural practice design firm is unique in the UK as we have our own in-house team of mortgage advisers who are completely independent and have access to the whole-of-market.

Let us know about your requirements and the property you’re interested in extending or purchasing, and we’ll assist you in finding the most suitable deals available. As a whole-of-market broker, we have access to a wide range of mortgages, and we’ll work tirelessly to find you the most favourable terms and rates.

We have access to exclusive deals from various lenders, including your own bank, that you may not be able to obtain directly. Our goal is to ensure that you secure the best possible deal for your circumstances, and we’ll guide you through the entire process from start to finish.

Whether you’re looking to extend your current home or purchase a new property, our team of experts will help you navigate the complexities of the mortgage market and find the most affordable and convenient options available.

Get in touch with us today to see how we can assist you with your home extension plans in Leicester.